Tough Times For Middle-Market Apartment Hunters

Moving is a hassle. Finding a desirable apartment in a preferred location can be difficult, especially if you’re looking for something in the middle range of quality and price. Generally referred to as Class B properties in real estate lingo, these “typical” apartments are in short supply.

The Existing Stock Is Full

Nationally, Class B apartment occupancy is at 96.1%. It’s tougher to find available units in the middle-tier product segment than in luxury Class A properties, which register occupancy of 94.4%.

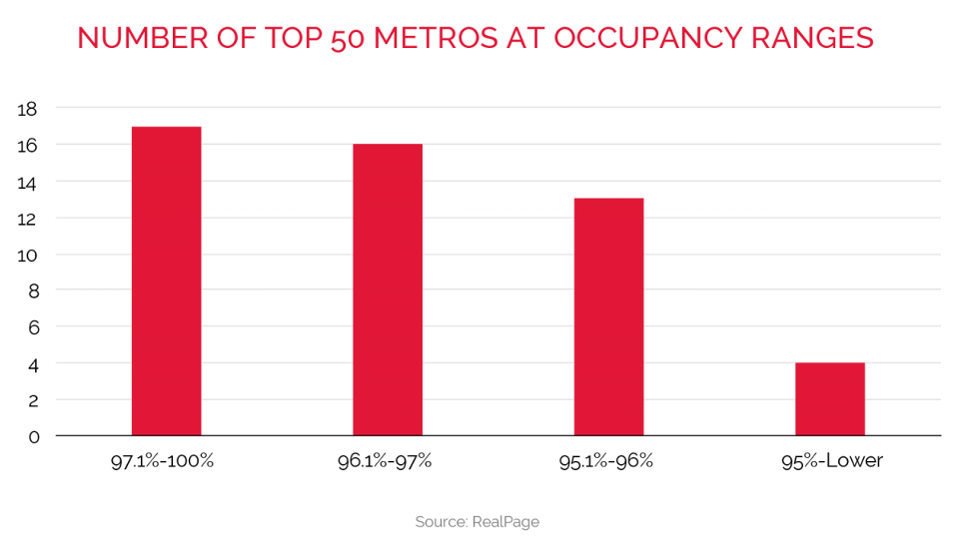

Middle-tier product occupancy tops 97% in 17 of the 50 largest markets, with Minneapolis and Northern New Jersey heading the list of exceptionally tight leasing environments. Class B product occupancy is running between 96% and 97% in another 16 metros, while 13 markets register occupancy in the range of 95% to 96%. That leaves only four of the 50 largest metros – Houston, San Antonio and Austin, Texas; plus Raleigh, N.C. – with Class B occupancy under the 95% level.

Prices Are Climbing

Today’s monthly rent for a Class B apartment averages $1,167, but what you’ll pay varies notably from one spot to another.

At the top extreme, the typical price of a middle-grade unit is $3,157 in New York and almost that high in San Francisco and San Jose. On the other end of the spectrum, Class B rents are less than a third as much in Greensboro/Winston-Salem, where the $786 typical rate remains cheapest among the 50 largest markets. Class B average rent registers under $1,000 in more than a dozen additional metros, most in the Midwest or Southeast. New-resident rents in the country’s Class B apartment sector are up 3.8% annually, with increases reaching highs of 10.8% in Sacramento, 8.9% in Seattle and 7.1% in Fort Worth. Class B apartment renters who choose to remain in place when their leases expire are facing price hikes that average 4.4%.

New Construction Serves the Upscale Audience

Tight market conditions for middle-tier apartments reflect that the audience is growing for this product niche at the same time that limited new supply is completing.

To some degree, Class B apartment demand reflects the same influences that are driving demand for rental housing generally. Solid job production is enabling new household formation. Furthermore, the population is heavy on young adults, who tend to be renters rather than homeowners.

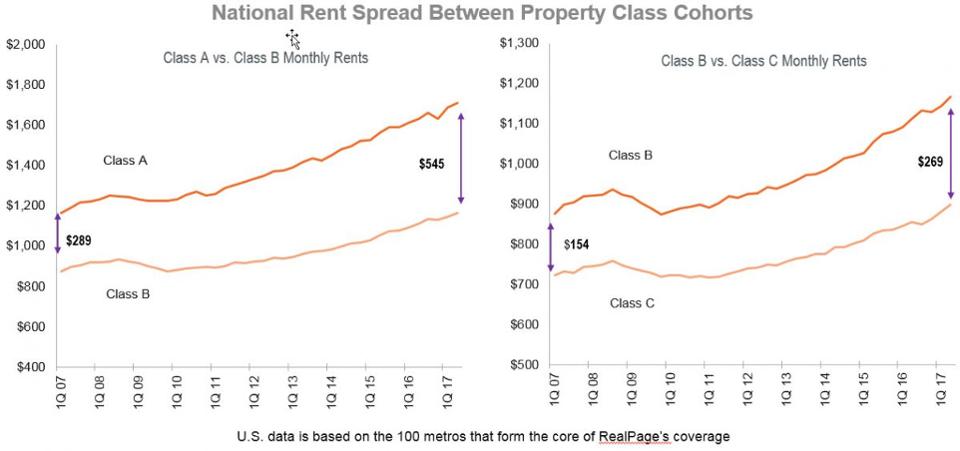

Demand for Class B apartments also is shaped by the fact that some renters who might have selected luxury rentals in earlier economic cycles simply can’t afford today’s most expensive options. With current average rents for Class A properties hitting $1,713, the price premium for the best units over their middle-tier counterparts reaches more than $500 monthly, or a whopping $6,500+ annually. Back in 2010, the price difference between Class A and Class B product was considerably smaller, around $350 per month.

Building locations and the structural characteristics of individual developments are pushing luxury development rents. Urban core land costs more than suburban sites, escalating the rents required to make building feasible in downtowns and nearby neighborhoods. The share of total construction concentrated in the urban core is rising, now at about a third of the entire volume. Even the product coming on stream in suburban zones often consists of mid-rise buildings with garage parking, a design that’s more expensive than two- or three-story buildings with surface parking.

Developers don’t lack interest in building apartments at more moderate price points. More affordable deliveries are simply tough to achieve, given costs for land, building authorizations, materials and labor. New Class B development generally is realistic only if long-term tax credits are part of the financial structure or if the building occurs in exurban settings on the periphery of metro area boundaries.

Axiometrics, a RealPage company, specializes in monitoring the apartment and student housing markets to provide a granular view of volatile market trends through the interactive AXIOPortal.